Explain the Different Types of Company Liquidation

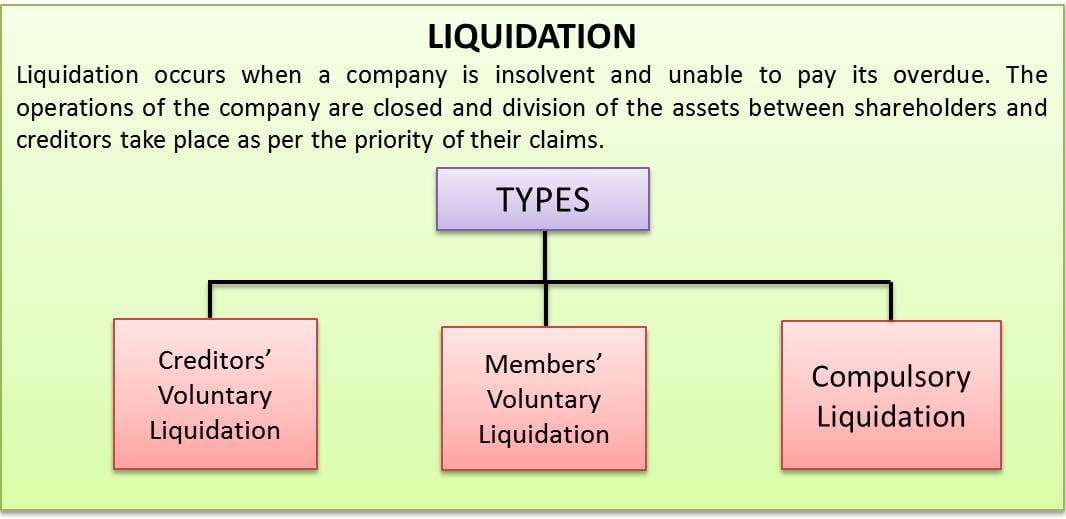

Carrying on business in the name of the company until the windup is satisfied. The most familiar form for many is compulsory liquidation which happens when a business has fallen into debt where a previously viable and profitable business is no longer solvent and creditors are petitioning for the company to be liquidated and for them to receive their outstanding debt.

Liquidation Meaning Process Types Examples Consequences

Involuntary liquidations are when a company is forced to liquidate and sell its assets by economic conditions company regulations or court order.

. If successful a liquidator will be appointed to the company. Voluntary liquidation. The shareholders basis in the stock of the business will fluctuate based on the income or loss recorded over the years which will affect the gainloss generated by the liquidation.

This is brought about when the directordirectors realize that the company will. The three forms of liquidation are. Selling immovable property at public auction or through a private contract.

If the owner cant pay its debt before the court date then the law would get involved and freeze the companys accounts. Compulsory Liquidation When a company couldnt pay its debt to the creditors then the creditors would have no other choice but to sell off the assets to wind up everything. When a company goes into liquidation its assets are sold to repay creditors and the business closes down.

Instituting or defending a suit prosecution or legal proceedings on behalf of the company. This type of liquidation is not forced by insolvency and is voluntarily decided by the owner. Chapter 7 is typically used when the debts of the business are so overwhelming that restructuring them is not feasible.

Introduction in regards to the different Types of Liquidation Liquidation or winding up is a process by which a companys existence is brought to an end. The court of law orders the business to. Understanding the Different Types of Limited Company Liquidation Creditors Voluntary Liquidation.

It is usually referred to as a liquidation. Five Hundred Dollar Rule. Chapter 7 bankruptcy can be used for sole proprietorships partnerships or corporations.

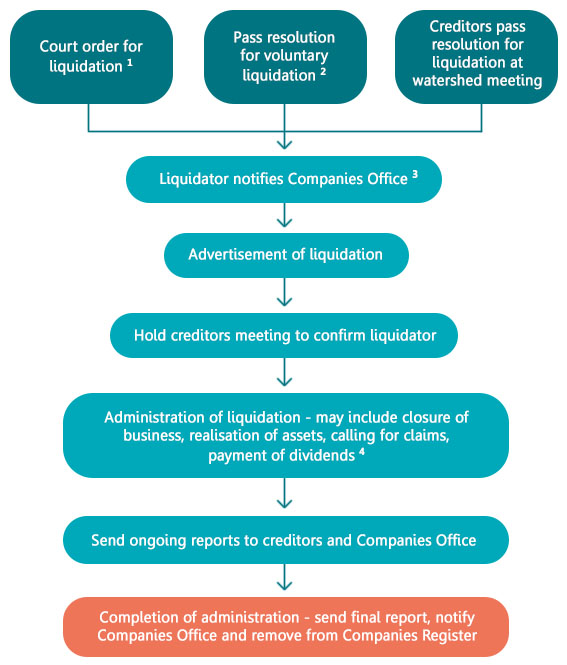

Any shareholders that have a stake in the company will also have a stake in the acquiring company. A common form of involuntary liquidation for public corporations is when a company goes bankrupt. All types of liquidation will be conducted by a licensed insolvency practitioner or an appointed Official Receiver who will handle the whole process from start to finish.

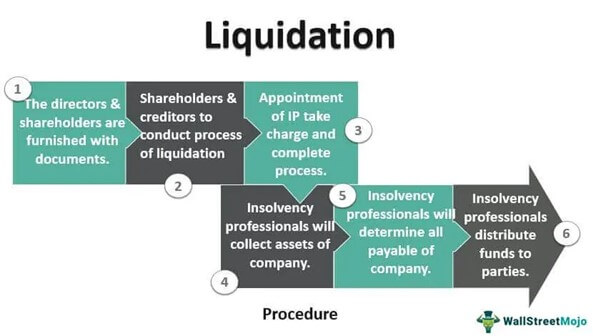

The process of a liquidation procedure will depend on the type of liquidation the company in question is being placed in to. There are several different types of liquidation as follows. Assets will be identified creditors repaid as.

If you have realised the company is insolvent it is crucial that your company does not take on any further credit agreements or makes preferential payments to certain creditors as this could be. Should the company not comply with this demand the creditor can apply to court to have the company wound up placed in liquidation. First a liquidator is appointed either by the Creditors or The Master of the High Court.

A regulation that prevents a bank or firm from liquidating a clients account to cover a margin call if the amount of. Some of the main types of liquidations are as follows. Chapter 7 business bankruptcy may be the best choice when the business has no viable future.

A Creditors Voluntary Liquidation CVL used by insolvent companies and is initiated. An MVL is aimed at solvent companies while a CVL is utilised in the instance of a company being insolvent. A Members Voluntary Liquidation MVL is the appropriate.

If your company is struggling to the point that its become insolvent and you wish to cease trading and close the company this process is called Creditors Voluntary Liquidation known as a CVL. The Liquidator represents the interests of all creditors. Members voluntary liquidation Creditors voluntary liquidation Compulsory liquidation Lets take a look at the different types of liquidation and the processes behind them in more detail.

Assume the same facts as in the above example except that in addition to 100000 cash X has an accrued tax liability of. Upon the liquidators appointment the directors. Start Afresh Liquidation if you wish to close your insolvent company and move your business into a new clean company.

The removal of the name only comes about on dissolution which is approximately three months after the closure of the. Members Voluntary Liquidation or Solvent Liquidation. This service is unique to Liquidationcouk as we are effectively entering an insolvent company into Creditors Voluntary Liquidation CVL but are using it as a business rescue process.

A Members Voluntary Liquidation MVL is a solvent Liquidation meaning a company is able to pay its debts in full together with interest. Acquisition Target Corporation Liquidation Target corporations are required to liquidate in Type C acquisition unless requirements are waived by the IRS. The company name remains live on Companies House but its status switches to Liquidation.

Voluntary liquidations are significantly different from involuntary liquidations. This procedure is usually used when the shareholder. There are three main types of liquidation and the one chosen will primarily depend on the financial position of the company at the time of the liquidation.

Reorganization provisions concern tax consequences not liquidation rules. The different types of liquidation insolvent liquidation.

Liquidation Definition Meaning Types And Process Efm

What Is Liquidation Understanding The Different Types Of Limited Company Liquidation

liquidation of company is the complete or partial dissolution of a company. It is often used when a company can't pay bills as it is going through financial difficulties. In order to protect creditors, liquidators are appointed by a court and are responsible for collecting unpaid funds and paying off debts.

ReplyDelete